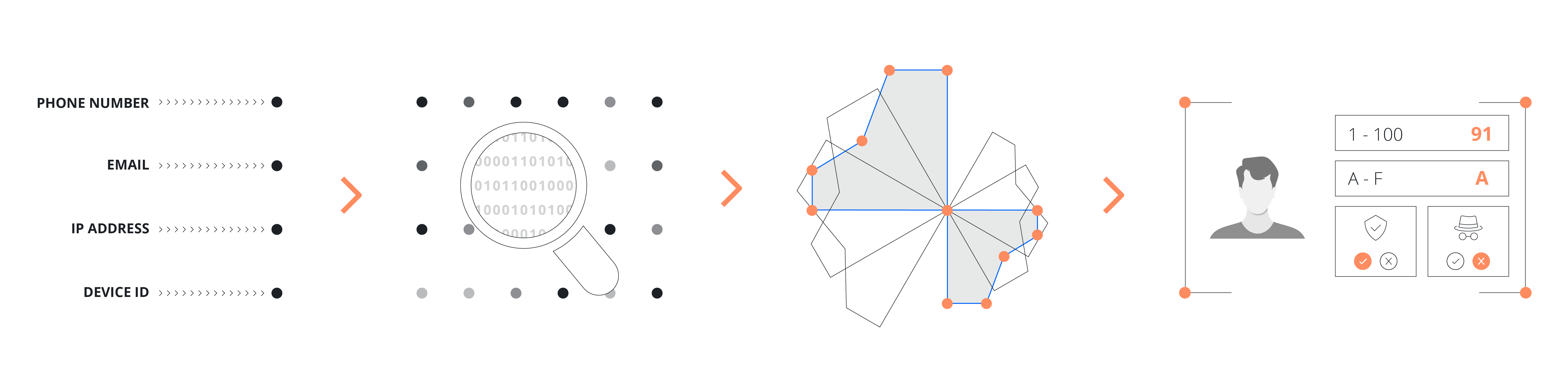

Step 1: Real time data processing and validation

Our system leverages a secure API to instantly access essential customer information, including phone number, IP addresses, senderID, content of the message, destination SMS fee, carrier information, etc. As this data flows in real-time, our advanced algorithms normalize and process it for each transaction, ensuring consistency and accuracy. We perform swift, comprehensive validation checks to verify the integrity and format of each data point. Our advanced system normalizes this data for each transaction as we perform comprehensive validation procedures to verify the integrity and format of each data point.

Step 2: Rapid historical analysis and risk assessment

Our advanced system performs a thorough examination of each input's historical data. This critical step involves reviewing past transactions associated with the data points we have access to. We check for patterns of suspicious activity and analyze the nature of previous transactions. Additionally, we cross-reference the data against known fraud patterns and compromised credentials databases.

Step 3: Dynamic feature generation

In case we do not detect any static fraud patterns in Step 2, we then leverage the power of Artificial Intelligence as we generate a rich set of features based on user behavior across our platform. This process involves calculating both static and dynamic parameters for each transaction in real-time. Our advanced algorithms consider factors such as phone number behavior, geographical patterns, destination information, content of the message, device usage and other data points, to create a comprehensive profile that helps identify unusual or potentially fraudulent activity.

Step 4: Customer specific Machine Learning models

In the final step, our state-of-the-art hierarchical Machine Learning system, tailored to each customer's unique needs, processes all the calculated features. This customized approach allows us to provide highly accurate fraud detection results. The system generates a risk grade, corresponding grade points offering transparent insights into the decision-making process. This empowers our customers to make informed choices about transaction approvals and risk management strategies.